The Importance of Comprehending the Significance of Risk Management in Various Industries

The Core Concept of Risk Management and Its Function

Risk Management, the cornerstone of lots of markets, rests on the recognition, assessment, and mitigation of uncertainties in an organization setting. It is an important method that permits companies to safeguard their properties, credibility, and total survival. By appropriately identifying potential risks, services can develop strategies to either protect against these threats from taking place or minimize their influence. The analysis process includes analyzing the chance and prospective intensity of these risks. The reduction process entails devising approaches to reduce their potential impact as soon as risks have been identified and examined. This process is cyclical and ongoing, ensuring that companies are gotten ready for the ever-changing nature of Risk in various markets. The primary objective, thus, is to promote durability among unpredictabilities.

Advantages of Carrying Out Risk Management in Business Procedures

Introducing the Role of Risk Management in Different Industries

While every market challenges its distinct collection of threats, the implementation of Risk Management approaches remains a typical in their quest of sustainability and growth. In the health care industry, Risk Management involves making certain client security and information defense, while in finance, it involves mitigating investment dangers and making sure governing compliance (importance of risk management). Construction business concentrate on employee safety and security, project delays, and budget plan overruns. In the modern technology field, companies alleviate cybersecurity threats and innovation obsolescence. Inevitably, the role of Risk Management throughout industries is to determine, assess, and reduce dangers. It is an essential component of strategic preparation, making it possible for organizations to safeguard their possessions, make the most of possibilities, and attain their objectives.

Real-life Study Demonstrating Effective Risk Management

To comprehend the relevance of Risk Management in these many fields, one can look to several real-life instances that highlight the successful application of these steps. Toyota, upload the 2011 earthquake in Japan, modified its supply chain Management to minimize disturbance dangers. These cases demonstrate exactly how sectors, discovering from situations, properly used Risk Management methods to lower future threats.

Future Fads and Developments in Risk Management Methods

Cybersecurity, as soon as an outer problem, has actually catapulted to the leading edge of Risk Management, with strategies focusing on action, prevention, and discovery. The assimilation of ESG (Environmental, Social, Governance) elements right into Risk Management is another growing trend, reflecting the raising acknowledgment of the role that environmental and social threats play in service sustainability. Therefore, the future of Risk Management exists in the combination of sophisticated innovation, innovative methods, and an alternative method.

Final thought

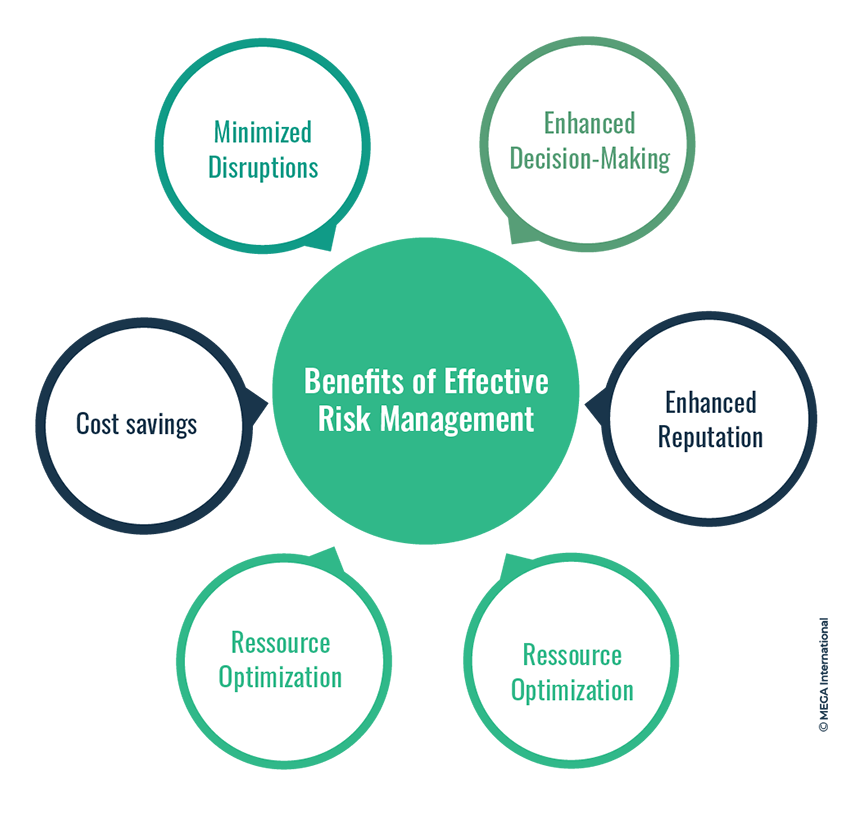

Finally, recognizing the significance of Risk Management across a spectrum of sectors is crucial for their longevity and prosperity. Customized techniques can help mitigate prospective risks, protect possessions, and foster stakeholder depend on. Furthermore, positive decision-making aids in regulatory conformity and optimizes resource usage. Inevitably, this link effective Risk Management adds to more sustainable and resilient organizations, highlighting the importance of this technique in redirected here today's dynamic and extremely competitive organization atmosphere.

While every market confronts its unique collection of dangers, the application of Risk Management techniques continues to be a typical in their pursuit of sustainability and development. In the medical care sector, Risk Management involves guaranteeing patient safety and security and information security, while in money, it entails mitigating investment risks and ensuring governing compliance. Inevitably, the duty of Risk Management throughout sectors is to identify, analyze, and alleviate risks. These instances demonstrate how sectors, learning from crises, efficiently used Risk Management strategies to reduce future risks.